by Steve Fawthrop, VP Agency Growth

How much can you afford to spend to acquire a new customer?

That is a fundamental question to the existence of a business, and a driver for how to justify the investment in sales and marketing as a part of the cost of operations.

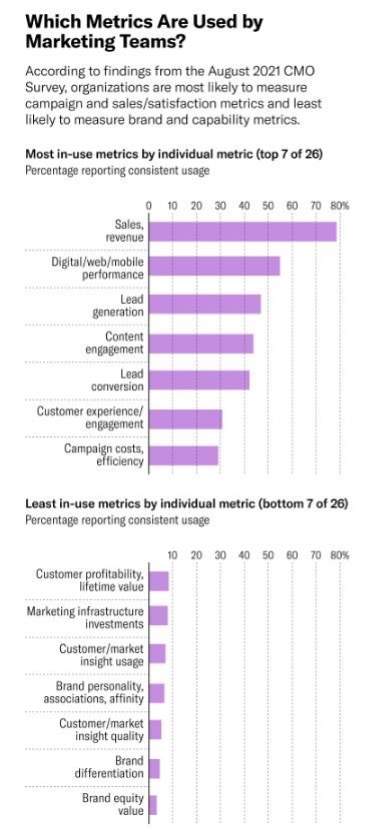

So, I was quite surprised when I saw a survey of importance in selective marketing goals and determining Customer Lifetime Value (CLV) was one of the lower ranked priorities, at less than 10%. Results are from the CMO Survey 2021 conducted by Duke University, supported by Deloitte and the American Marketing Association.

Profitability depends on how much value a new customer generates for your organization through the lifetime of the relationship.

The key variables that come into play are determining the cost of your product or service.

Some companies have very expensive products that yield sizable profits, so they can afford to spend tens-of-thousands of dollars, potentially into the millions, to acquire customers.

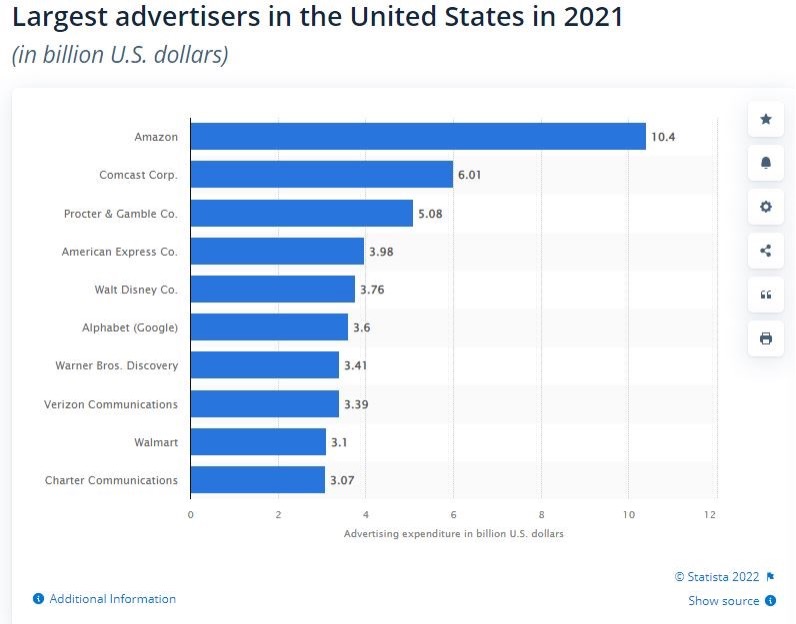

In 2021 the largest national advertiser, according to Ad Age, was Amazon, who spent over $10 billion. Amazon provides a vast variety of products, their roots, and services in both consumer segments (ex: general retail, Audible, Prime Video) and B2B (ex: Amazon Web Services, Fulfillment by Amazon).

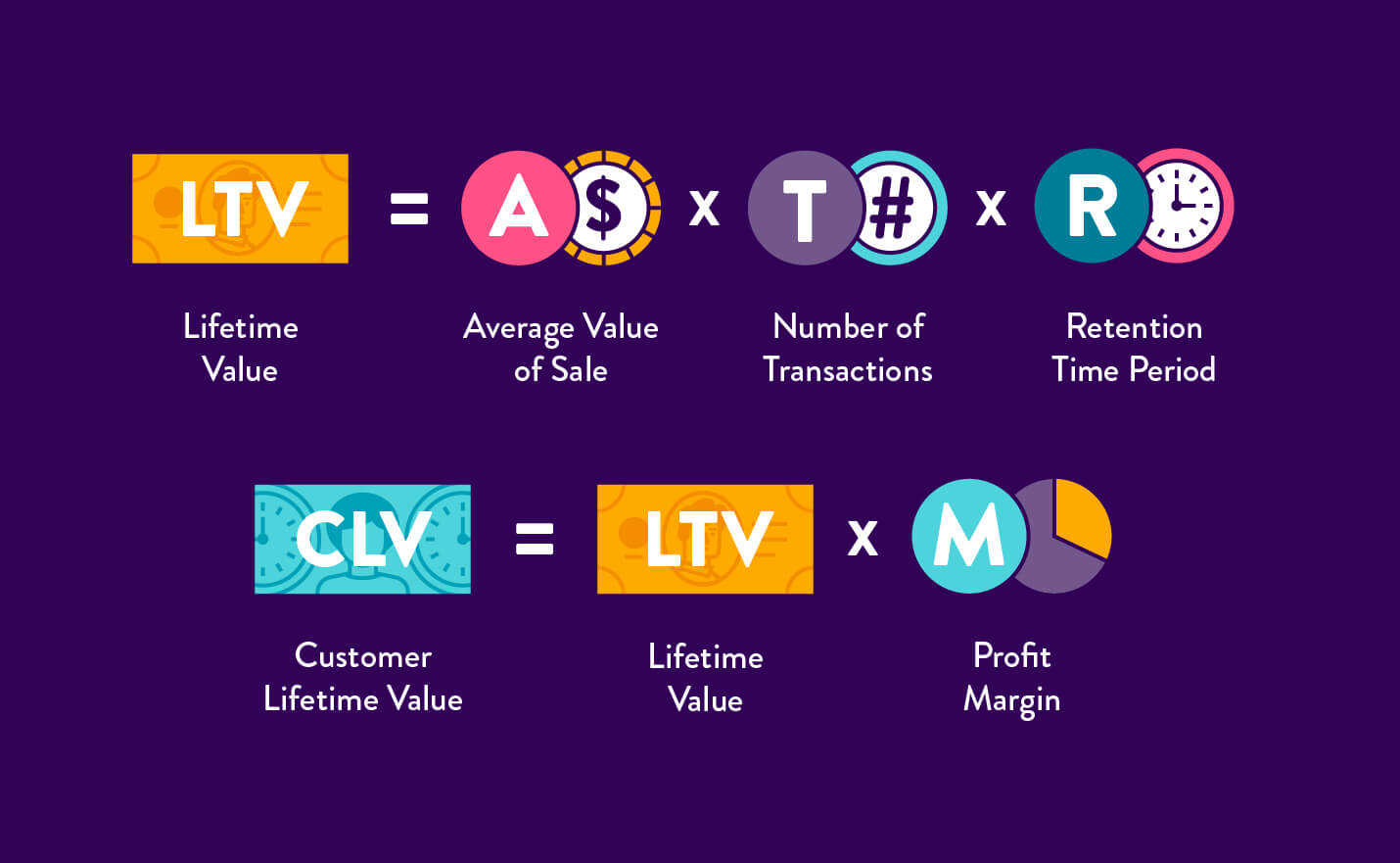

For all, a core practice is to start by measuring the Customer Lifetime Value (CLV) of your customers.

Basically, it’s the amount of Profit (Revenues – Operating Expenses) you expect to earn during the course of your relationship with a customer—from the first purchase to the last.

At more sophisticated companies, total revenue is not just projected from start date to the last transaction, but also includes an estimate when profit occurs. When CLV is clearly understood, marketers can then set Customer Acquisition Cost (CAC) goals that will provide an estimated return on investment (ROI) to the company and, thus, can be viewed in the overall context of revenue and profit.

So how to approach determining CLV?

Look first at Revenue. You have acquired a new customer. What happens next? The answer varies widely based on the business model. A few examples:

- An initial sale may lead to more referenced sales for some kind of products or services than others.

A consultant I know worked with a national chain that provides tutoring services. He analyzed different aspects of the customer and their total value. Digging deeper led to a variety of questions.

As an example, a new customer purchases 50 hours of tutoring services for their child. How many times will they renew, if at all? Is there a younger sibling that will need tutoring in a year or two? Will they refer other families to the company?

This referral dynamic was incredibly important to help them understand and build a CLV model—30 percent of all new customers eventually referred another family, who in turn would purchase, renew, and make referrals of their own.

- A subscription service (ex: streaming audio like Spotify or identity protection like Lifelock) acquires a new customer. For how many months will they pay the monthly fee before they cancel, if they cancel at all?

Most service platforms have different service tiers. Can the subscriber be upsold or cross-sold during the relationship? Is there a consistent percent who upgrade? Do they have particular characteristics that lead to an upgrade? If so, a deeper analysis will help in determining how to maximize their value.

- An opportunity may come through the need for incremental services in addition to on-going services.

Many managed services providers (MSPs) for IT services charge a monthly fee “per seat” for each employee supported, but over the course of a relationship the customer will need incremental services like a new server, new networking if they move or expand their office or buy replacement computers through the MSP because of an already established relationship.

The MSP may not know which individual customers will need additional services, but over time can determine the average needs (and revenues) of additional services across their customer base as a ratio of business split between monthly recurring revenue (MMR) and project revenue/incremental sales.

- Revenue per user may be indirect but be viewed as part of the LTV.

There is a free phone service that allows for wi-fi voice calls, texts, video calls and minimal data, so how do they make money?

Directly they offer incremental tiers of data that can be purchased, but 65 percent of users stay with the basic service.

Indirectly the company gains value from each customer because advertising is served on the phone screen of the user. Thus, advertising revenue contributes to the LTV of users with an indirect revenue source to the basic service. This is consistent with how free television and radio have thrived over the years.

Of course, the activity of one single customer doesn’t really matter. What’s important is the aggregation of customers to get a big-picture view of average customer revenue.

Operating Expenses are the second important component of CLV—what does it cost to actually acquire the customer, deliver and support the product or service?

Depending on the business model this can include many different factors, ranging from manufacturing to fulfillment and servicing costs. As with revenue, what’s important is the average customer operating expense.

In combination, the CLV of an average customer is the average revenue minus the average operating expense. Qualtrics offers a CLV calculator that makes it easy, and offers some suggestions on how to apply CLV to your business:

- Optimize marketing spend by identifying and prioritizing your most valuable customers.

- Reduce churn and drive loyalty investing in and nurturing high-value customers.

- Identify costly experience gaps and then feed or shore up your customer experience program to make a bigger impact.

- Design new experiences that grow the business by detecting those which drive a positive impact and digging deeper to find out why and building upon that opportunity.

Implications for Marketers

The first and most obvious implication is that CLV, along with guidance from company leadership, will determine Customer Acquisition Cost goals.

Ted Wilkins, a marketing consultant at DIRECTed Consulting, in a blog post on CLV outlined a few scenarios:

Consider two companies, each with $1,000 customer CLV. One company is highly focused on profitability, so sets a CAC target well below the CLV—maybe $350—and earns a healthy return on its marketing investment.

The other company, however, is highly focused on growth, so is willing to pay a lot more—perhaps even up to $1,000 and simply break even. He notes he has worked with both types of companies—the key is to ensure that both customer CLV and company goals are clear.

The more nuanced implication is at the segment level, where CLV may vary widely.

For example, you might find that younger customers, based on their lifecycle stage, have significantly higher (or lower) CLV compared to older ones.

Modern capabilities to do more sophisticated analysis can shift a company into more individualized understanding of customers to better fulfill their interests, increase customer satisfaction and optimize profitability.

For example, in a recent Harvard Business Review story on leveraging digital advantages, they give the example that in 2001, with roughly 500,000 subscribers, Netflix recommendations to customers were chosen only 2 percent of the time. By 2020, with 200 million users, recommendations were accurate 80 percent of the time. The ability to help the subscriber discover offerings of interest more easily leads to greater satisfaction and retention.

You don’t know until you look at the data. If you can identify meaningful differences upon which you can execute, then you can optimize your marketing by setting CAC goals at the segment level.

Based on what is outlined, does your company have a solid understanding of CLV? How do you use it in your role?

This post is an expansion of a blog post summarizing Customer Lifetime Value from Ted Wilkins. We want to acknowledge the framework of this post is based on his original writing.

Does your business need an agency partner? Learn how EXACTA MEDIA can help. We specialize in end-to-end media management from strategy through buy and optimization. Connect with our team of experts to learn more.